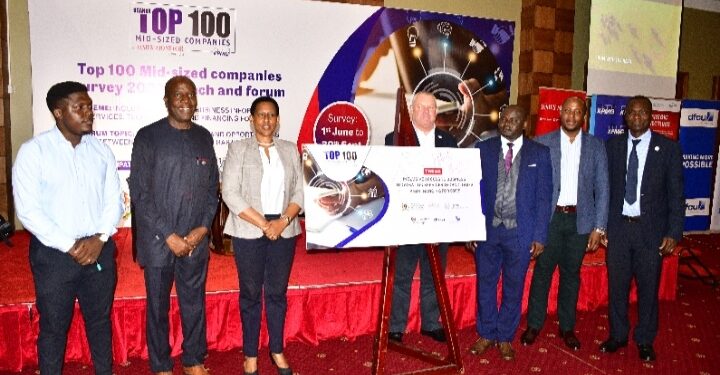

Dfcu Bank has reiterated its unwavering commitment to the SME sector and its crucial role in Uganda’s economy. The remarks were made by Charles Mudiwa, CEO of dfcu Bank at the launch of the highly anticipated 2023 edition of the Top 100 Mid-sized Companies Survey at an event, held at the Sheraton Kampala Hotel.

The bank joined Nation Media Group, KPMG, Uganda Investment Authority, the Uganda Securities Exchange, and the Ministry of Tourism, Wildlife, and Antiquities to identify the fastest-growing medium-sized companies in Uganda.

This year’s survey launch event focused on the theme of “Inclusive Access to Business Information Services, Technologies, and Financing for SMEs,” with a particular emphasis on exploring business linkages and opportunities within the oil and gas sectors.

Mudiwa stated, “As a wholly Ugandan Bank, it is our paramount responsibility to create an environment that enables businesses and the Ugandan economy to thrive. We are honored to be part of this partnership that benefits numerous SMEs, empowering them to reach their full potential. SMEs are the driving force behind innovation, employment generation, and income growth. However, their success relies on factors such as access to essential services and resources.”

Aligning with this year’s survey theme, dfcu Bank is fully committed to supporting small and medium enterprises by providing tailored financing solutions, introducing innovative services like online banking for businesses, facilitating access to physical and online learning sessions, and offering personalized banking through dedicated Relationship Managers.

SMEs play a significant role in the Ugandan economy, contributing approximately 20% of the country’s GDP and employing over 2.5 million people, accounting for around 90% of the workforce, according to the Uganda Bureau of Statistics. These enterprises operate across various sectors and serve as the backbone of Uganda’s private sector, driving economic diversification and development.

With Uganda’s expanding domestic market, a growing middle class, and increasing consumer demand, SMEs have abundant opportunities to expand their customer base. Furthermore, membership in the East African Community (EAC) provides access to a larger regional market of over 150 million people, enabling SMEs to leverage regional integration initiatives and explore new markets.

One thought on “Dfcu reiterates its commitment to the SME sector”