As the school holidays start, both schools and parents are gearing up for the Back-to-School season to ensure a smooth transition into the last term of the year. While the focus remains on education and personal growth, the financial aspect of this preparation should not be overlooked. Banks offer a plethora of financial products tailored to meet the unique needs of schools and parents during this critical time. From funding educational initiatives to managing personal finances, these products can play a pivotal role in setting the stage for a worry-free back-to-school season.

1. Institutional Loans.

Banks understand the importance of quality education and are often willing to educational institutions with tailored loan solutions. These financial resources can be used to enhance infrastructure, invest in technology, and jump-start school activities as the school waits for funding through school fees. With favorable interest rates and flexible repayment options, these loans enable educational institutions to create an enriching learning environment.

2. Student Savings Accounts.

Parents can collaborate with banks to open student savings accounts for their children. These accounts not only serve as a safe haven for allowances but also serve as a practical tool for teaching kids about money management. Many banks offer special perks such as no minimum balance requirements and competitive interest rates to encourage both parents and students to save.

3. Education Investment Plans.

Education investment plans are tailored financial products that allow parents to save for their child’s future education expenses. These plans often come with specific interest rates and various investment options, ensuring that parents have a suitable vehicle for accumulating funds over time. By starting early and consistently contributing, parents can alleviate the financial burden of higher education.

4. Personal Loans for Education.

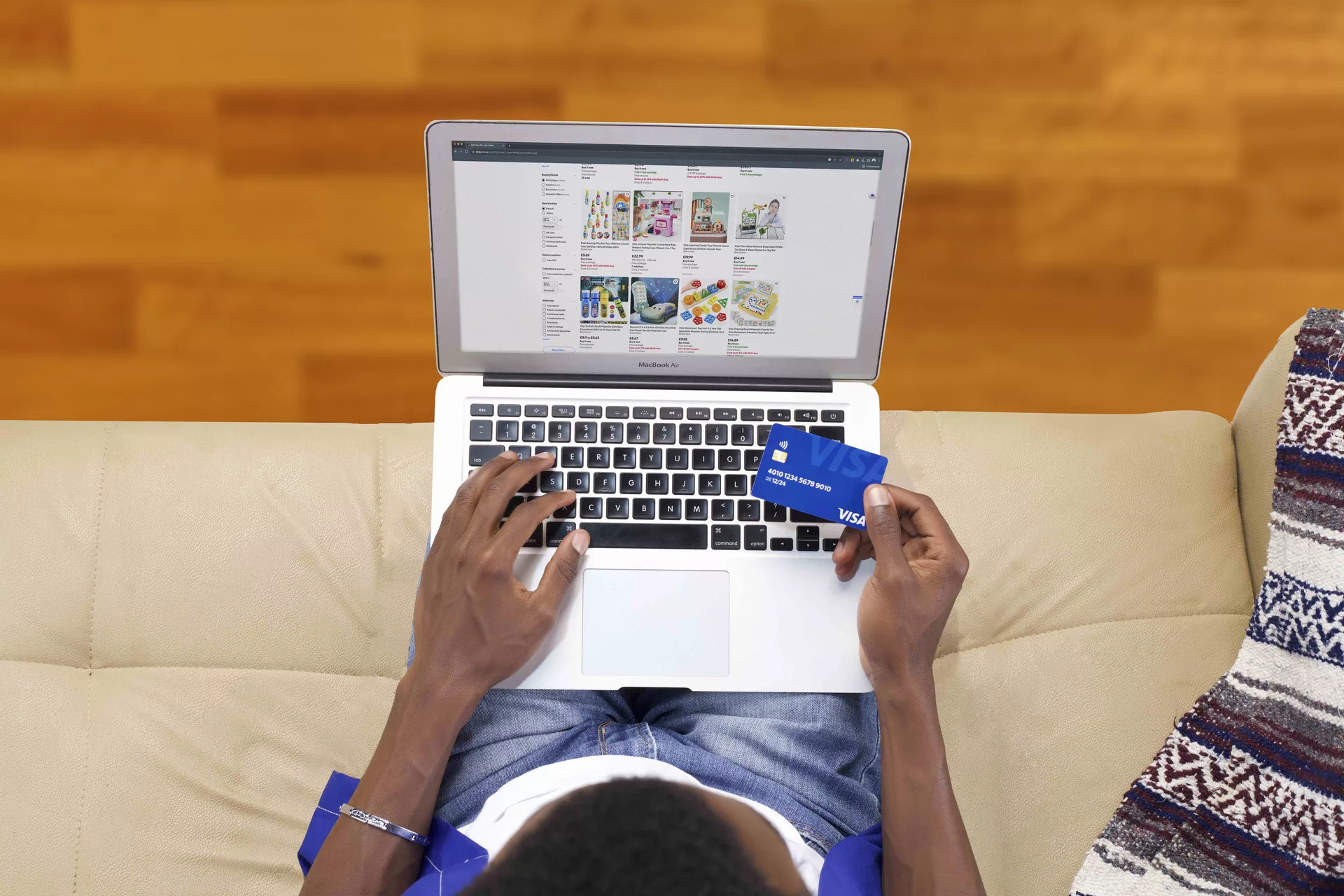

Parents can utilize personal loans offered by banks to cover education-related expenses, including tuition fees, books, and supplies. These loans are designed to provide quick and convenient access to funds, ensuring that financial constraints do not hinder a student’s academic pursuits. With manageable repayment terms, these loans can be a lifeline during the demanding back-to-school period.

5. Budgeting Tools and Financial Education Workshops.

Many banks offer budgeting tools and financial education workshops that cater specifically to parents and schools. These resources can be invaluable in helping individuals and institutions manage their finances effectively. From understanding cash flow to learning about investment strategies, these workshops equip participants with the knowledge and skills necessary for sound financial management.

6. Payment Solutions for Tuition and Fees.

Banks often provide payment solutions that streamline the process of paying tuition and fees. These solutions can include online payment gateways and mobile apps, allowing parents to make transactions conveniently from anywhere. This eliminates the need for time-consuming in-person visits and paperwork, enhancing efficiency for both parents and schools.

The back-to-school season is a critical time for both educational institutions and parents, and banks have recognized this by offering a range of financial products tailored to their needs. These offerings can significantly contribute to a successful academic term when taken advantage of. As the new term approaches, leveraging these financial products can pave the way for a seamless and prosperous academic journey.