In a world driven by financial transactions and economic decisions, instilling a solid understanding of banking concepts and money management in children is an invaluable gift. Early exposure to the world of banking can empower youngsters with essential life skills that will serve them well into adulthood. By introducing children to banking in a thoughtful and engaging manner, parents and educators can set them on a path towards financial responsibility and success.

1. The Importance of Early Financial Education: Children are sponges for knowledge, and their capacity to grasp foundational concepts is remarkable. Introducing banking concepts from an early age provides them with the tools to understand the significance of saving, spending, and making wise financial choices. Moreover, cultivating financial literacy helps children develop critical thinking skills, instills patience, and fosters a sense of responsibility.

2. The Basics of Banking: Start by explaining the fundamental concepts of banking. Describe what banks are, how they safeguard money, and the services they offer, such as savings accounts, checking accounts, and loans. Simplify these concepts using relatable examples to help children grasp the concepts easily.

3. Savings and Spending: Teach children the value of saving money by introducing them to the concept of a savings account. Explain how a savings account allows money to grow over time through interest, and set up a small savings account for them. Encourage them to save a portion of their allowance or any money they receive as gifts.

4. Setting Goals: Show children how setting financial goals can motivate them to save. Whether it’s buying a toy, going on a family trip, or donating to a charity, help them understand that having a goal in mind makes saving more meaningful.

5. Hands-On Experience: Take your child to a bank branch to open their first savings account. Let them interact with the bank staff and experience the process firsthand. This practical exposure can make banking less abstract and more tangible for them. Many banks have come up with products and solutions dedicated to children.

6. Money Management: Introduce the concept of budgeting by discussing how money should be allocated for various needs and wants. Teach them the importance of distinguishing between needs (essential expenses) and wants (non-essential items). Encourage them to allocate a portion of their funds for savings and another for spending.

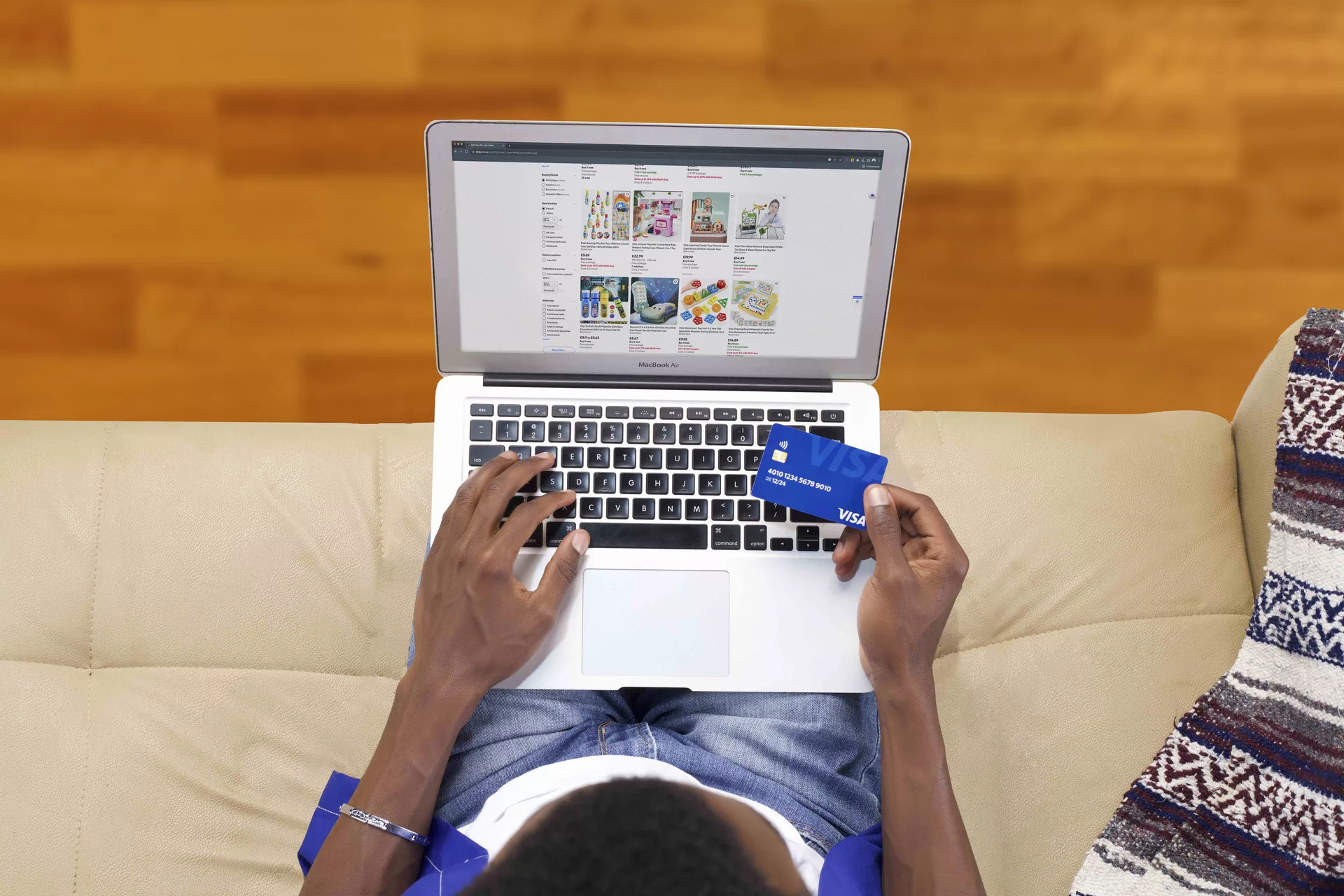

7. Online and Mobile Banking: In today’s digital age, explain how online and mobile banking work. Show them how to check their account balance, transfer money, and even make virtual deposits. Emphasize the importance of online security and the need to keep their account information private.

8. Charitable Giving: Teach children about the significance of giving back by involving them in charitable endeavors. Discuss the concept of donations and how even a small contribution can make a positive impact on others.

9. Learning through Games and Activities: Utilize educational games, books, and apps designed to teach children about money and banking in a fun and interactive way. Many resources are available that can transform learning into an enjoyable adventure.

10. Leading by Example: Children learn a great deal from observing their parents’ financial habits. Be a positive role model by demonstrating responsible money management, saving practices, and making thoughtful spending decisions.

Introducing children to the world of banking lays the foundation for financial literacy, a lifelong skill that is essential for navigating the complexities of the modern world. By making financial concepts relatable, engaging, and enjoyable, parents and educators can equip children with the knowledge and confidence they need to become responsible financial stewards as they grow into adulthood. The journey toward financial education begins early, and the rewards are boundless.

30hd5q

kjy9je