As technology continues to advance, so do the risks associated with it. The rise of deepfake technology has brought about new challenges for financial institutions, prompting the need for robust security measures to counter the potential cyber threats it poses.

In a world where a simple scan of your face can reveal what you might look like decades into the future or even merge your image with that of a celebrity, the allure of deepfake technology is undeniable. Creating altered images and audio recordings with striking accuracy has transformed from a novelty to a potential weapon in the arsenal of cybercriminals. While often used for light-hearted entertainment, the sinister potential of deepfakes is becoming increasingly apparent.

What happens when your likeness is exploited for financial gain? As the accessibility and affordability of deepfake technology increase, the urgency to shield against its potential misuse has taken center stage.

The Deepfake Challenge

A deepfake is essentially a manipulated video, visual, or audio recording that leverages deep learning techniques to fabricate a person’s appearance or voice, often making them appear to say or do things they haven’t. These seemingly authentic but fabricated creations serve as the foundation for various cybercrimes, notably digital injection attacks. These attacks, which sidestep device cameras or infiltrate data streams, have raised significant concerns within the realm of cybersecurity.

Murray Collyer, Chief Operating Officer of iiDENTIFii, underscores the looming threat posed by digital injection attacks. He states, “Digital injection attacks present the highest threat to financial services, as the AI technology behind it is affordable, and the attacks are rapidly scalable.” These attacks have demonstrated their global reach, with instances of hundreds of attacks being launched from a single location within a 24-hour period.

Financial Landscape and Digital Transformation

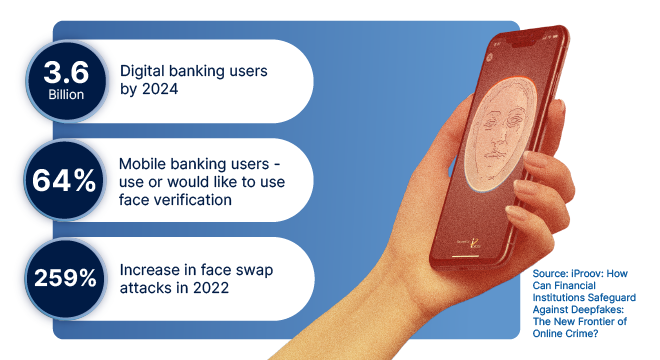

As more Africans embrace digital banking, the convergence of the financial landscape and technology has paved the way for a new era. A recent study by Discovery Bank and Boston Consulting Group reveals that an overwhelming 86% of South Africans are inclined to conduct their banking activities digitally, particularly through apps. This transition has been propelled by previously unbanked individuals and further accelerated by the COVID-19 pandemic.

However, this shift also brings with it increased vulnerabilities to financial and cybercrimes. Interpol highlights the intertwining nature of financial and cybercrimes, dubbing them the world’s primary crime threats, projected to surge in the coming years.

Defense Strategies Against Deepfakes

Despite the ominous potential of deepfakes, the financial industry has tools at its disposal to fortify its defenses against these fraudulent schemes. Advanced face biometric technology, integrated with liveness checks such as winks or blinks, is an evolving safeguard. Liveness detection is a biometric method designed to discern whether the presented data comes from a real human rather than a fabricated source.

While many liveness detection technologies can thwart attempts involving physical images, such as printed photos or masks, to deceive the camera, the challenge lies in detecting digital injection attacks.

Collyer underscores the necessity for specialized technology to counter deepfakes. Within iiDENTIFii, success has been achieved using sophisticated 4D liveness technology, bolstered by a timestamp and verified through a meticulous three-step process. This process cross-references the user’s selfie and ID document data against pertinent government databases, thus ensuring a high level of identity authentication.